Ever feel like you’ve missed the boat on Bitcoin? With prices soaring, it’s easy to think you’re too late to the party. But what if I told you that, according to one key indicator, the crypto celebration is just getting started? That’s right—we might still be in the early innings of Bitcoin’s next massive bull run.

In this article, we’re going to dive deep into a fascinating tool called the “Satoshimeter.” We’ll break down what it is, how it works, and what it’s telling us about current Bitcoin price cycle. Forget the crystal balls and complicated charts; we’re going to explain this in a way that’s easy to understand, even if you’re new to the crypto world. So, grab a cup of coffee, and let’s talk about where Bitcoin’s price might be headed next.

Bitcoin’s Wild Ride: Are We at the Top?

Let’s be real, watching Bitcoin’s price has been like being on a rollercoaster. One minute it’s hitting all-time highs, and the next, everyone is panicking about a crash. It’s enough to give anyone whiplash! A lot of people are asking the golden question: have we reached the peak of this cycle?

It’s a valid concern. After all, what goes up must come down, right? Well, in the world of cryptocurrency, it’s a bit more complicated than that. That’s where indicators like the Satoshimeter come in, helping us cut through the noise and get a clearer picture of what’s really going on.

What is the Satoshimeter and Why Should You Care?

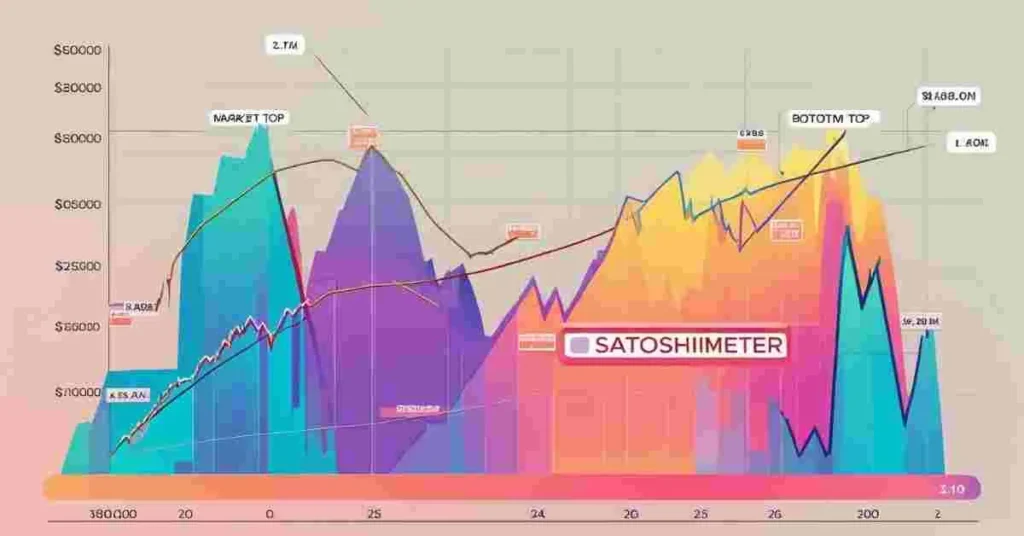

So, what exactly is this “Satoshimeter”? Think of it like a weather forecast for Bitcoin. Developed by the well-regarded crypto analyst Stockmoney Lizard, the Satoshimeter uses on-chain data—information directly from the Bitcoin blockchain—to gauge where we are in the current market cycle.

It’s not just some random guess. The Satoshimeter has a solid track record. In the past, when the indicator showed low readings, it was a pretty good sign that the market had hit its bottom. Conversely, when the readings were sky-high, it signaled that a market top was near. As any savvy investor knows, having a tool that can help identify these turning points is incredibly valuable. For more on the importance of on-chain data, you can check out resources from CoinDesk or CoinTelegraph.

What the Satoshimeter is Telling Us Right Now

So, what’s the verdict? According to the latest readings from the Satoshimeter, we are currently in the mid-phase of the bull cycle. Yes, you read that right. Despite the recent price surge that saw Bitcoin flirt with the $120,000 mark, the indicator suggests we’re not even close to the peak.

Stockmoney Lizard himself has weighed in on this, stating that while the indicator’s readings are elevated, they have stabilized. This is a crucial point because it suggests that there is still plenty of room for growth. In a recent tweet, the analyst shared a chart of the Satoshimeter, highlighting how the current levels are similar to previous mid-cycle phases that were followed by significant price increases.

Key Takeaways from the Satoshimeter:

- We’re in the Middle: The current readings point to the mid-phase of the bull cycle.

- More Room to Grow: The indicator suggests that the market has not yet reached its peak.

- Historical Precedent: Past cycles show that this phase is often followed by another major price surge.

A $200,000 Bitcoin Price? It Might Be Closer Than You Think

Now for the part you’ve been waiting for: the price prediction. Based on the Satoshimeter’s current readings and historical patterns, Stockmoney Lizard has projected that Bitcoin could reach a staggering $200,000 in this cycle.

Let that sink in for a moment. If this prediction holds true, it would mean that we are on the cusp of another monumental rally. Of course, this isn’t a guarantee. The crypto market is notoriously volatile, and a major correction is always a possibility. However, having data-backed insights like this can help us make more informed decisions. Government reports on digital assets and analyses from financial institutions are also valuable resources for understanding the broader market trends.

What This Means for You: Actionable Tips for Crypto Investors

Whether you’re a seasoned trader or just crypto-curious, this information is incredibly valuable. Here are a few actionable tips to consider:

- Don’t Panic Sell: If you believe in the long-term potential of Bitcoin, the Satoshimeter’s data suggests that now is not the time to panic sell.

- Consider Dollar-Cost Averaging (DCA): Instead of trying to time the market, you can invest a fixed amount of money at regular intervals. This strategy can help reduce the impact of volatility.

- Stay Informed: Keep up with credible crypto news sources and analysts. The more you know, the better equipped you’ll be to navigate the market.

- Have a Strategy: Whether you’re in it for the long haul or looking for short-term gains, it’s important to have a clear investment strategy and stick to it.

Conclusion: The Journey is Far From Over

In the fast-paced world of cryptocurrency, it’s easy to get caught up in the hype and fear. However, by using tools like the Satoshimeter, we can take a step back and look at the bigger picture. The data suggests that Bitcoin’s current journey is far from over, and the most exciting chapters may still be ahead.

So, while no one can predict the future with 100% certainty, the evidence points to a bullish outlook for Bitcoin. As always, do your own research, invest wisely, and never invest more than you can afford to lose.

Now, I want to hear from you. Do you think Bitcoin will reach $200,000 in this cycle? Share your thoughts in the comments below!