Ever tried to make a transaction on Ethereum during peak hours and felt like you were paying more in fees than for the actual item? 🤯 You’re not alone. That frustratingly slow and expensive experience is a core problem in the crypto world, but there’s a powerful solution taking center stage: the dynamic duo of Layer 1 vs Layer 2 blockchain solutions.

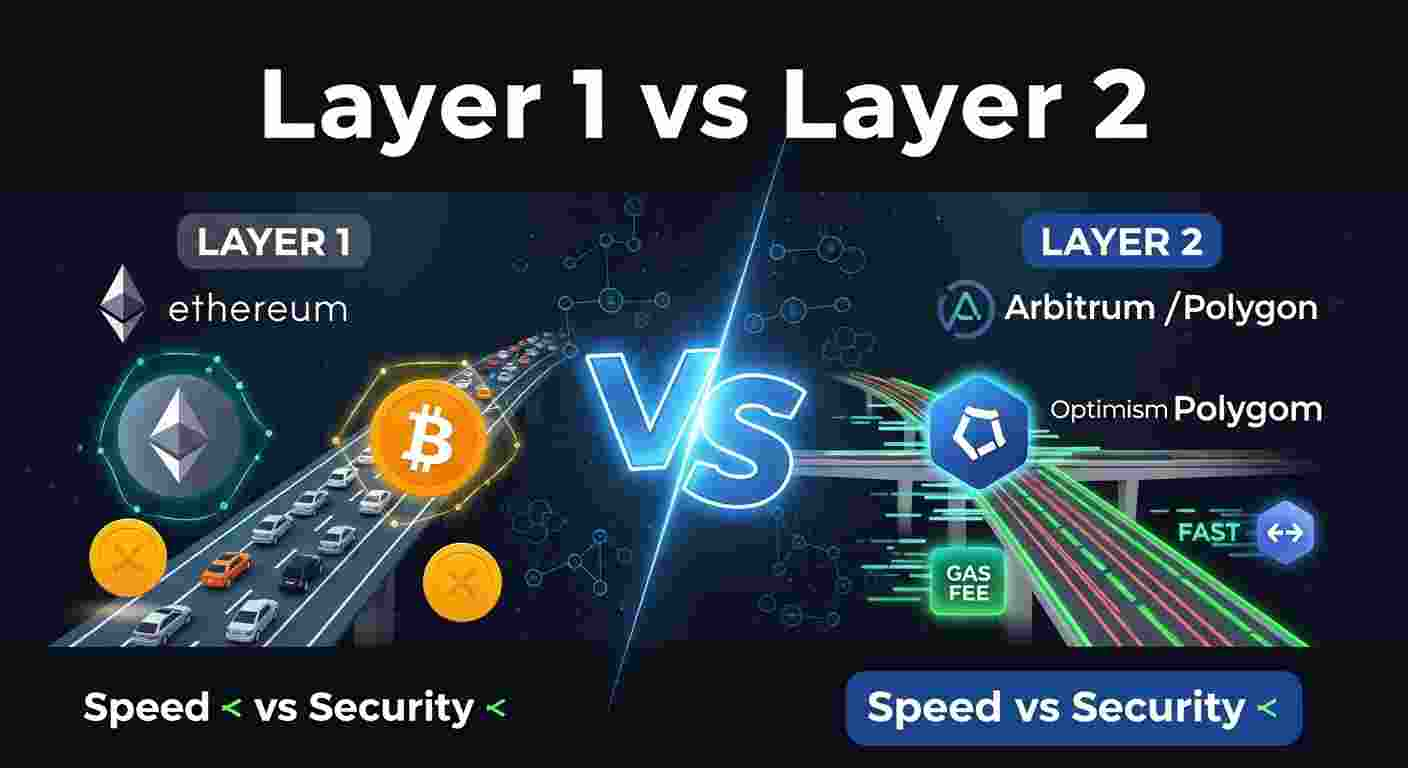

Think of it like city traffic. Layer 1 is the main highway system, but what happens when it gets jammed? You get gridlock. Layer 2s are the clever flyovers and express lanes built on top, designed to get you where you’re going faster and cheaper. In this article, we’re going to break down exactly what these layers are, how they differ, and why their teamwork is paving the way for the future of crypto.

What’s the Deal with Layer 1 Blockchains? The Bedrock of Crypto

Let’s start with the basics. A Layer 1 (L1) blockchain is the foundational network, the main stage where everything happens. It’s the ultimate source of truth.

The Mainnet: Your Single Source of Truth

Think of networks like Bitcoin and Ethereum—these are the OG Layer 1s. They are the fundamental architecture responsible for:

- Processing and validating all on-chain transactions.

- Maintaining the security of the entire ecosystem through consensus mechanisms (like Proof-of-Work or Proof-of-Stake).

- Serving as the public, unchangeable ledger.

Every transaction that happens directly on these networks is an L1 transaction. This layer is designed to be incredibly secure and decentralized, but that often comes with a trade-off.

The Blockchain Trilemma: The Big L1 Headache

Ethereum’s co-founder, Vitalik Buterin, famously coined the term “blockchain trilemma.” It states that it’s incredibly difficult for a blockchain to achieve all three of these properties at once:

- Security: Resistance to attacks.

- Decentralization: No single entity is in control.

- Scalability: The ability to handle a high volume of transactions.

Most Layer 1s, like Ethereum, have historically prioritized security and decentralization, which is why scalability (and those pesky gas fees) has been a major challenge. As a prominent crypto analyst on X (formerly Twitter) noted, “A Layer 1 chain must first be a fortress. Speed is a luxury that can be built on top, but security is non-negotiable.”

Enter Layer 2 Solutions: The Express Lane for Your Transactions

If Layer 1 is the secure but often congested main highway, Layer 2 (L2) solutions are the smart, high-speed toll roads built on top of it. Their entire purpose is to take the transaction load off the main chain to make things faster and more affordable.

So, How Does This Magic Work?

Instead of processing every single transaction on the main chain, L2 solutions handle them “off-chain” in a separate environment. They then bundle hundreds or even thousands of these transactions into a single neat package and send a compressed summary back to the Layer 1 chain for final validation.

It’s like having a bar tab. Instead of swiping your card for every single drink, you run a tab (transact on L2) and then settle the final bill in one go at the end of the night (settle on L1). This efficiency is a game-changer. According to data from crypto analytics platforms, Layer 2 solutions have reduced transaction fees on Ethereum by up to 95% in some cases.

A Look at the L2 All-Stars

There are a few popular types of L2s, each with its own approach:

- Rollups: These are the most popular solutions for Ethereum. They “roll up” transaction data and post it back to the L1. The two main types are Optimistic Rollups (like Arbitrum and Optimism) and ZK-Rollups (like Polygon zkEVM and StarkNet).

- State Channels: Perfect for a high volume of transactions between specific users. The best example is Bitcoin’s Lightning Network, which allows for near-instant, super-cheap BTC payments.

- Sidechains: These are independent blockchains that run parallel to the main chain and are connected via a two-way bridge. They offer more flexibility but may have different security models.

As reported by CoinDesk, the total value locked (TVL) in Ethereum Layer 2 networks has surged in the past year, signaling massive user adoption and trust in these scaling solutions (placeholder for external link).

Layer 1 vs Layer 2 Blockchain Solutions: A Friendly Face-Off

To make it crystal clear, let’s put them head-to-head.

| Feature | Layer 1 Blockchain (e.g., Ethereum) | Layer 2 Solution (e.g., Arbitrum) |

| Primary Role | Security, Decentralization, Data Finality | Scalability, Speed, Lower Transaction Costs |

| Security | Inherits security from its own consensus | Inherits security from the underlying Layer 1 |

| Speed (TPS) | Slower (e.g., Ethereum at ~15 TPS) | Much Faster (Can reach thousands of TPS) |

| Cost (Gas Fees) | Can be very high during network congestion | Typically very low, a fraction of L1 fees |

| Data Handling | All transactions are processed on-chain | Transactions are processed off-chain and bundled |

Export to Sheets

Better Together: How L1 and L2 are a Dynamic Duo

The conversation isn’t really about Layer 1 vs Layer 2 blockchain solutions as rivals. It’s about their synergy. They are not competing; they are complementing each other.

The Layer 1 chain, like Ethereum, acts as the global settlement layer—the ultimate judge and jury that guarantees the security and finality of all transactions. It’s the trusted foundation.

The Layer 2 solutions are the execution layers. They are the nimble, fast-moving agents that handle the day-to-day grind of transactions, allowing decentralized applications (dApps) and users to operate without being bogged down by the main chain’s limitations.

This collaborative model is what the Ethereum Foundation calls its “rollup-centric roadmap.” As detailed in reports from CoinTelegraph, the future of Ethereum’s scalability relies heavily on the continued growth and innovation of these L2 ecosystems (placeholder for external link).

What’s Next? The Future is Layered

So, there you have it. Layer 1 provides the unshakeable security and decentralization we need, while Layer 2 delivers the speed and low costs necessary for mass adoption. Together, they solve the blockchain trilemma, creating a robust, secure, and scalable ecosystem for everyone.

As you continue your journey in the crypto space, understanding this relationship is key. Whether you’re an investor, a developer, or just a curious enthusiast, embracing this layered approach will help you navigate the future of digital finance.

Ready to dive deeper and stay ahead of the curve? Subscribe to our newsletter for weekly insights and expert analysis delivered straight to your inbox!

Now I want to hear from you. Which Layer 2 project are you most excited about, and why do you think it has the potential to be a game-changer? Drop your thoughts in the comments below