Layer 1 vs Layer 2: The Ultimate Guide to Understanding Blockchains in 2025

Ever felt that sting of paying more in fees than the actual crypto transaction was worth? You’re trying to swap $20 of a token, and the network demands $45 in gas fees. It feels broken, right? Welcome to the club! This isn’t just a random annoyance; it’s one of the biggest challenges in the crypto world, and a multi-billion dollar race is on to solve it for good.

If you’ve spent any time in crypto, you’ve heard the terms “Layer 1” and “Layer 2” thrown around. They might sound like technical jargon from a sci-fi movie, but I promise you, they’re simpler than you think. And understanding the difference between them is the secret to unlocking faster transactions, ridiculously low fees, and making smarter investment decisions in 2025.

In this friendly, no-nonsense guide, we’re going to break down the Layer 1 vs Layer 2 debate. We’ll ditch the complex code-speak and use simple analogies you can actually relate to. Think of me as your crypto-savvy friend here to give you the inside scoop. We’ll cover what these layers are, why they’re crucial for the future of Web3, and how you can use them to your advantage. By the end, you’ll not only understand the difference but also feel confident navigating the ever-evolving world of blockchain technology.

Let’s dive in and demystify the tech that’s shaping the future of money.

Chapter 1: The Foundation – What Exactly is a Layer 1 Blockchain?

Alright, let’s start from the ground up. A Layer 1 (L1) blockchain is the main, fundamental network itself. It’s the bedrock, the source of truth, where everything happens directly on the chain.

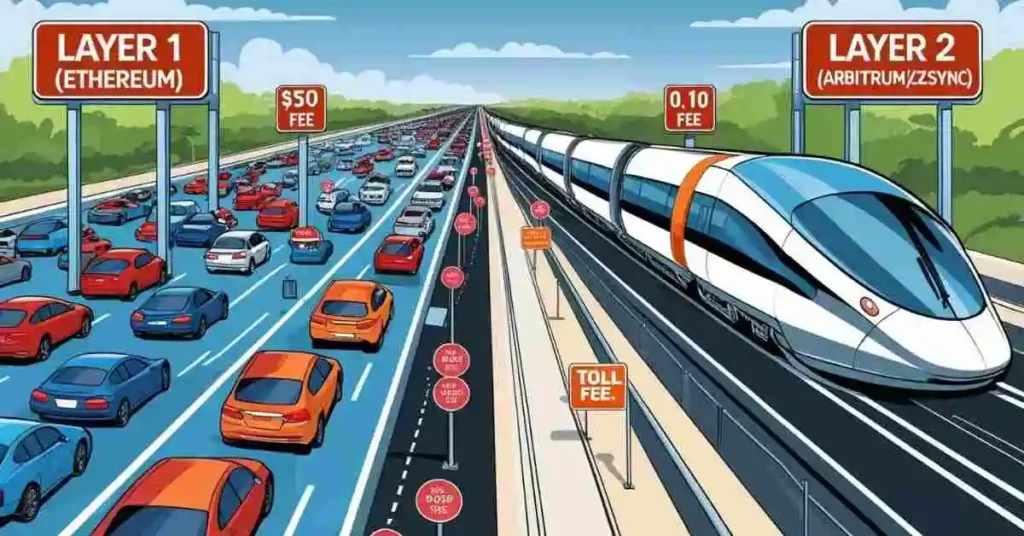

Think of a Layer 1 blockchain as a major city’s main highway system, like the M25 around London or I-405 in Los Angeles.

- The Highway: This is the blockchain itself (e.g., Ethereum, Bitcoin).

- The Cars: These are the transactions (sending crypto, minting an NFT, etc.).

- The Traffic Rules: These are the network’s consensus mechanisms (like Proof-of-Work or Proof-of-Stake) that ensure everyone agrees on the transactions.

Every single car (transaction) has to travel on this main highway. The network’s security guards (validators or miners) check every car to make sure it’s legitimate before letting it merge and become a permanent part of the road’s history. This makes the highway incredibly secure and reliable.

The Inevitable Traffic Jam: The Blockchain Trilemma

Here’s the problem. When everyone wants to use the highway at the same time (like during rush hour or a major event), you get a massive traffic jam. The road gets congested, traffic slows to a crawl, and the toll booths (gas fees) start charging exorbitant prices to prioritize who gets through.

This is what we call the “Blockchain Trilemma,” a term famously coined by Ethereum’s co-founder, Vitalik Buterin. A blockchain can typically only optimize for two out of three of the following features:

- Security: How resistant the network is to attacks.

- Decentralization: How distributed the network is, preventing any single entity from having control.

- Scalability: How many transactions the network can handle per second (TPS).

Layer 1 blockchains like Bitcoin and Ethereum have historically prioritized Security and Decentralization. This is why they are considered the gold standard for securing value. But this choice came at the cost of Scalability, leading to the high fees and slow speeds we all love to complain about.

Meet the Titans: Popular Layer 1 Blockchains in 2025

While all are L1s, they each take a slightly different approach to solving the trilemma.

- Bitcoin (BTC): The OG. Unbelievably secure and decentralized, but slow and expensive for everyday transactions. It’s more like a digital Fort Knox—perfect for storing immense value, not for buying coffee.

- Ethereum (ETH): The king of smart contracts. It’s the busiest highway by far, hosting thousands of applications (dApps) for DeFi, NFTs, and more. Its popularity is also its biggest weakness, causing legendary gas fee spikes. As a recent CoinDesk report highlighted, despite its high fees, Ethereum continues to hold the majority of DeFi’s total value locked (TVL)

[link to CoinDesk report on Ethereum TVL]. - Solana (SOL): The speed demon. Solana took a different route, building a super-fast, single-chain highway designed for high throughput (thousands of TPS). It sacrifices some decentralization for this speed, leading to occasional network outages but offering incredibly low fees.

- Avalanche (AVAX): The modular specialist. Avalanche uses a unique “subnet” architecture, which is like having dedicated express lanes for different applications, preventing one app’s traffic from slowing down the entire network.

- Other Notables: Don’t forget about Cardano (ADA), known for its methodical, research-driven approach, and newer players like Aptos (APT) and Sui (SUI), which were built from the ground up with scalability in mind.

Layer 1s are the essential foundation. They are the ultimate arbiters of truth and security. But for blockchain to truly go mainstream, we can’t all be stuck in traffic. We need a faster way to get around.

Chapter 2: The Express Lane – What is a Layer 2 Solution?

If Layer 1 is the congested main highway, then a Layer 2 (L2) is a high-speed express train or an overhead flyover built on top of it.

A Layer 2 is a separate protocol built to work with a Layer 1 blockchain. Its entire purpose is to take the transaction load off the main chain, process it much faster and cheaper, and then report back to the main chain with the final results. It’s all about increasing efficiency without sacrificing the security of the underlying L1.

Here’s how it works in our highway analogy:

Instead of every single car driving on the main highway, thousands of passengers (transactions) board a high-speed train (the Layer 2). This train travels on its own track above the traffic. It gets to its destination almost instantly and for a fraction of the cost. Once it arrives, it sends a single, simple summary back down to the main highway’s records: “All these 1,000 passengers traveled safely from Point A to Point B.”

The main highway doesn’t need to process 1,000 individual cars anymore—just one simple update from the train. This frees up an immense amount of space on the highway, reducing congestion for everyone.

The Tech Behind the Magic: How Do L2s Work?

The two dominant types of Layer 2 solutions you’ll hear about in 2025 are Rollups. Their job is to “roll up” or bundle hundreds of off-chain transactions into a single transaction that they submit to the Layer 1.

There are two main flavors of rollups:

1. Optimistic Rollups (The “Innocent Until Proven Guilty” Method)

- How they work: Optimistic Rollups assume all the transactions in their batch are valid by default—hence the name “optimistic.” They post the batch to the Layer 1 and open a “challenge period” (usually about a week). During this time, anyone can submit a “fraud-proof” if they spot an invalid transaction. If no challenges are made, the batch is confirmed as final on the L1.

- Pros: They are compatible with the Ethereum Virtual Machine (EVM), making it easy for developers to move their dApps over.

- Cons: The main drawback is the long withdrawal time. To move your funds back to the L1, you have to wait for the challenge period to end.

- Top Players: Arbitrum and Optimism are the undisputed leaders here. They host billions in value and are home to some of DeFi’s biggest names. Base, the L2 developed by Coinbase, is another optimistic rollup that has seen explosive growth due to its seamless integration with the Coinbase ecosystem.

2. Zero-Knowledge Rollups (The “Mathematical Proof” Method)

- How they work: Zero-Knowledge Rollups (ZK-Rollups) take a more advanced approach. They use complex cryptography to generate a “validity proof” (often called a SNARK or STARK) for every batch of transactions. This proof mathematically guarantees that all transactions in the batch are valid, without revealing any of the underlying data (hence “zero-knowledge”). They submit this proof to the L1, which can instantly verify it.

- Pros: Insanely secure and efficient. Since the validity is proven upfront, there’s no need for a long challenge period, meaning withdrawals to L1 are much faster. According to CoinTelegraph, many analysts believe ZK-technology is the long-term endgame for blockchain scaling

[link to CoinTelegraph article on ZK-Rollups]. - Cons: The technology is incredibly complex, making it harder for developers to build on. However, new zkEVMs are bridging this gap.

- Top Players: zkSync, StarkNet, Polygon zkEVM, and Linea are the frontrunners in the ZK space, each competing to offer the best performance and developer experience.

Chapter 3: Layer 1 vs Layer 2 – The Head-to-Head Comparison

So, let’s put them side-by-side. Understanding these key differences is crucial for deciding where to put your money and your time.

| Feature | Layer 1 (e.g., Ethereum Mainnet) | Layer 2 (e.g., Arbitrum, zkSync) | The “Friend” Analogy |

| Primary Goal | Security & Decentralization | Scalability & Low Fees | The L1 is your super-secure bank vault. The L2 is your debit card for everyday spending. |

| Transaction Speed | Slower (e.g., 10-15 TPS for Ethereum) | Much Faster (e.g., 1,000-4,000+ TPS) | Ordering a pizza on L1 is like waiting for it to be delivered by mail. On L2, it’s like a drone dropping it off in minutes. |

| Transaction Fees | High and volatile ($5 – $100+) | Extremely Low ($0.01 – $0.50) | The L1 toll road costs a fortune during rush hour. The L2 express train has a flat, cheap fare. |

| Security Model | Natively secure; responsible for its own security. | Inherits security from its parent L1. | The L1 is the fortress. The L2 is a secure armored truck that operates under the fortress’s protection. |

| Data Handling | All transactions are processed and stored directly on-chain. | Transactions are executed off-chain and bundled before posting to L1. | The L1 keeps a detailed, word-for-word diary of every event. The L2 writes a quick summary of the day’s events. |

| Examples | Bitcoin, Ethereum, Solana, Avalanche, Cardano | Arbitrum, Optimism, zkSync, StarkNet, Polygon, Base | The foundational networks vs. the scaling solutions built on top. |

This isn’t just theory; it has a massive impact on your crypto journey.

Chapter 4: Why Should You Care? The Real-World Impact in 2025

Okay, so why does this Layer 1 vs Layer 2 discussion actually matter to you, the user, the trader, the creator? The answer is simple: money and user experience.

The evolution to a multi-layer ecosystem is the single biggest factor making crypto usable for normal people.

Case Study: The DeFi Trader

Let’s say you’re a DeFi enthusiast named Alex. Last year, Alex wanted to provide liquidity to a pool on Uniswap on the Ethereum mainnet.

- Transaction 1 (Approve Token): $15 gas fee. Wait 1 minute.

- Transaction 2 (Add Liquidity): $35 gas fee. Wait 2 minutes.

- Total Cost: $50 and several minutes just to make one move.

Now, in 2025, Alex does the exact same thing on Uniswap, but this time through the Arbitrum Layer 2 network.

- Transaction 1 (Approve Token): $0.05 fee. Settles in 3 seconds.

- Transaction 2 (Add Liquidity): $0.12 fee. Settles in 3 seconds.

- Total Cost: $0.17 and less than 10 seconds.

The difference is staggering. For active traders, this means being able to enter and exit positions quickly and affordably, without having profits eaten away by fees. Data from DeFiLlama consistently shows that L2s now process several times more daily transactions than the Ethereum mainnet itself [link to DeFiLlama dashboard], proving users are voting with their wallets.

The Gamer and the NFT Artist

Think about blockchain gaming (GameFi) or minting NFTs. These actions often require many small, quick transactions.

- On a Layer 1: High gas fees would make most blockchain games unplayable. Can you imagine paying $10 every time you wanted to buy an in-game item? Or an NFT artist paying hundreds in gas just to mint a collection?

- On a Layer 2: These fees shrink to pennies, making microtransactions feasible. Games can be fast and responsive, and artists can mint large collections affordably, opening up the creator economy to a much wider audience.

Chapter 5: The Million-Dollar Question – Is Layer 2 Safe?

This is probably the most important question you should be asking. If you’re moving your assets off the ultra-secure Ethereum mainnet, are you taking a big risk?

The short answer is: Layer 2s are designed to be extremely safe, but the level of security can vary.

The core principle is that L2s inherit the security of their parent L1. They don’t have their own separate group of validators to secure billions of dollars. Instead, they rely on the L1 (like Ethereum) to be the ultimate judge and enforcer of the rules.

However, there are nuances:

- Centralized Sequencers: Many L2s, especially in their early stages, use a centralized “sequencer.” This is a single entity responsible for ordering transactions and posting them to the L1. While it makes the L2 fast, it introduces a single point of failure. The industry is actively working towards decentralizing sequencers, but it’s a risk to be aware of.

- Bridge Security: To move funds from an L1 to an L2, you use a “bridge.” These bridges have historically been a major target for hackers. It’s crucial to only use official, battle-tested bridges associated with the major L2 projects.

- Smart Contract Risk: Like any protocol in crypto, L2s are made of code. A bug in the smart contract code could put funds at risk. This is why audits and open-sourcing the code are so important.

As a rule of thumb, ZK-Rollups are considered the security gold standard because their validity proofs are mathematically unbreakable. Optimistic Rollups are also very secure, relying on economic incentives and a fraud-proof system to keep everyone honest.

Expert Insight: In a recent discussion on the future of Ethereum, Vitalik Buterin emphasized the “rollup-centric roadmap,” stating that the future security and scalability of the network is inextricably linked to the success and maturation of Layer 2 solutions.

Chapter 6: A Glimpse into the Future: Competing or Collaborating?

So, is this a war between Layer 1 vs Layer 2? Will L2s eventually make L1s obsolete?

Absolutely not.

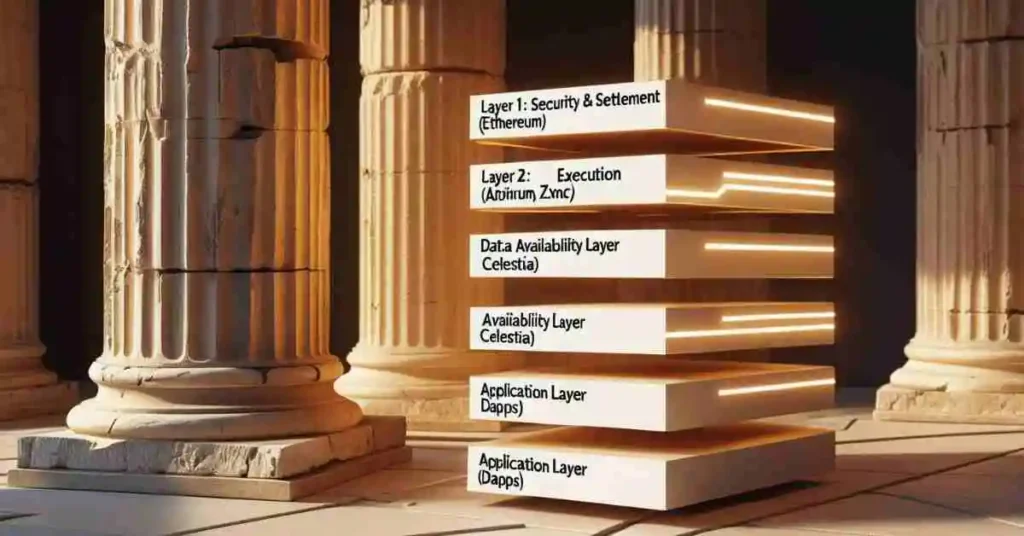

This isn’t a competition; it’s a symbiotic relationship. They are two parts of a whole, working together to create a more powerful and efficient system.

- Layer 1s are becoming the “settlement layer” or the “global courthouse.” Their main job is to provide ultimate security and be the final, undisputed record of truth. They are where high-value transactions will settle and where L2s will anchor their security.

- Layer 2s are becoming the “execution layer” or the “local branches.” This is where the bulk of user activity will happen—the trading, gaming, social media, and everyday transactions. They provide the speed and low cost needed for mass adoption.

This is part of a larger trend in blockchain architecture known as the “Modular vs. Monolithic” debate.

- Monolithic Chains (e.g., Solana): Aim to do everything on a single, highly optimized Layer 1.

- Modular Chains (e.g., Ethereum): Are breaking the blockchain down into specialized layers. Ethereum handles settlement, while L2s handle execution, and other protocols like Celestia are emerging to handle data availability.

The future is undeniably multi-chain and multi-layer. Getting comfortable using bridges and moving between these layers will soon be as common as switching between apps on your phone.

Chapter 7: Your Actionable Guide – How to Choose Between L1 and L2

Feeling ready to jump in? Here’s a simple cheat sheet to help you decide which layer to use for different activities.

- For long-term, high-value storage (HODLing):

- Use a Layer 1. Store your Bitcoin or Ethereum on the mainnet in a secure hardware wallet. This is your digital vault.

- For active DeFi trading, yield farming, or swapping tokens frequently:

- Use a Layer 2. Your best bet is an established L2 like Arbitrum, Optimism, or zkSync. The fee savings will be enormous and dramatically improve your experience.

- For exploring new NFT collections or playing blockchain games:

- Use a Layer 2. Most new and exciting projects in these areas launch on L2s like Polygon, Base, or StarkNet to attract users with low transaction costs.

- For developers launching a new dApp:

- Strongly consider a Layer 2. You’ll provide a much better user experience for your customers, which is critical for growth and adoption.

- If you are brand new to crypto:

- It’s okay to start on a Layer 1 to get a feel for things. Buy some ETH on a major exchange like Coinbase or Binance. But your first goal should be to learn how to bridge a small amount to a Layer 2 to experience the difference firsthand.

Chapter 8: Busting the Myths: Separating Fact from Fiction

Let’s clear up some common misconceptions floating around the Layer 1 vs Layer 2 conversation.

Myth 1: “Layer 2s are just a temporary fix until Layer 1s get faster.”

- Busted: This is false. Even with upgrades, Layer 1s will likely never be cheap or fast enough for global-scale activity. Ethereum’s own roadmap is centered around empowering L2s, not replacing them. They are a permanent and essential part of the scaling strategy.

Myth 2: “All L2s are the same.”

- Busted: Absolutely not. As we discussed, Optimistic and ZK-Rollups operate on fundamentally different principles. They have different security models, withdrawal times, and levels of decentralization. Always do your own research (DYOR) before bridging a large sum to a new L2.

Myth 3: “Using a Layer 2 is too complicated for beginners.”

- Busted: It used to be, but not anymore! With exchanges like Coinbase and Binance now allowing direct withdrawals to L2s like Arbitrum and Base, and with user-friendly bridges, moving funds is easier than ever. It’s a skill worth learning, and it only takes a few minutes.

Final Thoughts: Embracing the Multi-Layer Future

In 2025, the Layer 1 vs Layer 2 debate isn’t about picking a winner. It’s about understanding how these two powerful technologies work together to solve blockchain’s biggest hurdles.

Layer 1s are the secure, decentralized foundation, the bedrock of trust. Layer 2s are the scalable, efficient engines of activity, bringing speed and affordability to the masses. Together, they are paving the way for a future where blockchain is not just an investment asset, but a seamless part of our digital lives.

By getting a handle on these concepts, you’re not just learning technical trivia—you’re future-proofing your knowledge and setting yourself up to navigate the next wave of crypto innovation with confidence. You can now save money on fees, explore new applications, and make more informed decisions.

The internet of value is being built, one layer at a time. And now, you know how to read the map.

Now I want to hear from you:

What’s your favorite Layer 2 solution to use, and why? Or if you’re new to them, what’s the first dApp you plan to try on an L2?

Drop your thoughts in the comments below! Let’s get the conversation started.